Philippines Moves Towards Fee-Free Small Transactions: A Push for Inclusive Digital Economy

District Representative

Cagayan de Oro City, 1st District

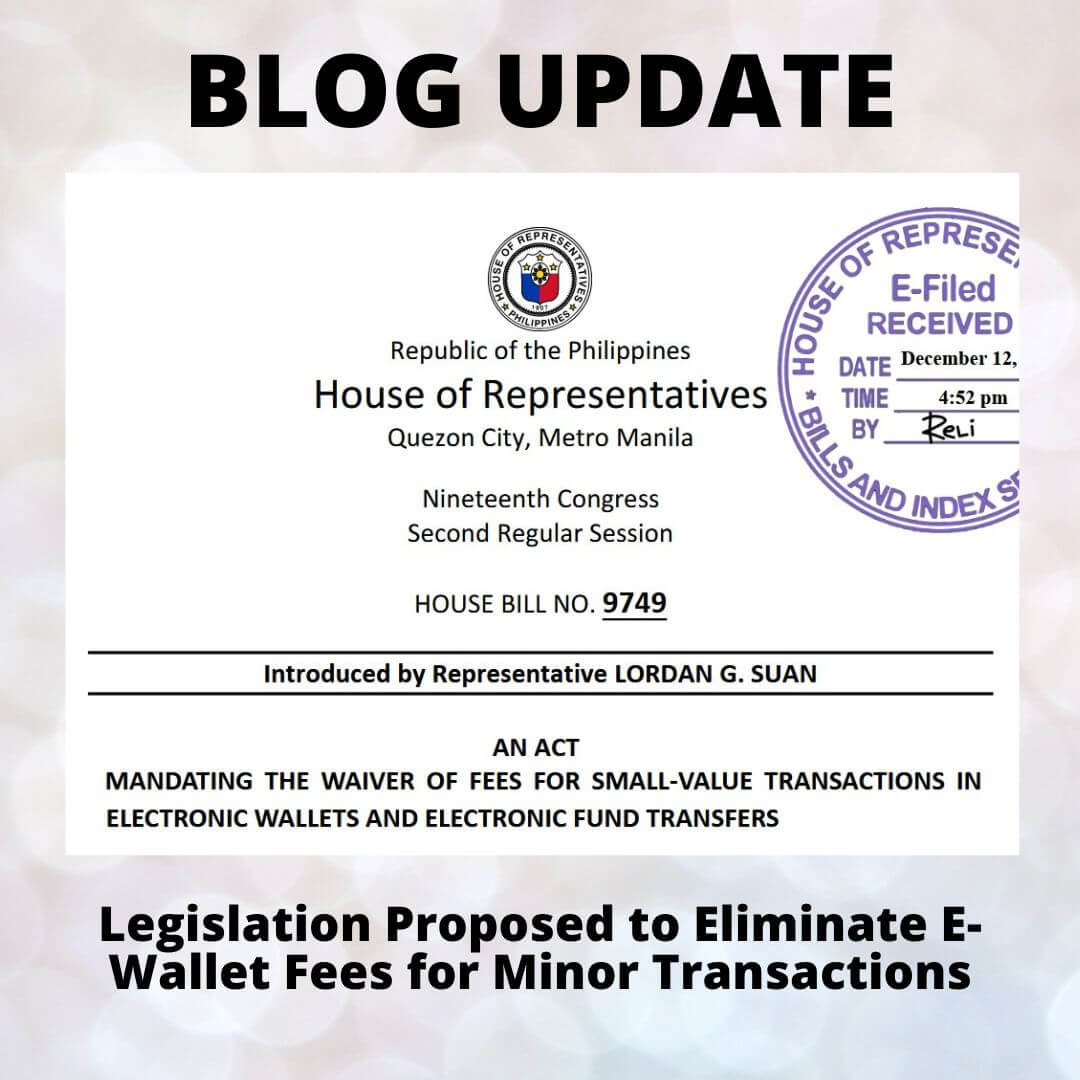

In an effort to foster financial inclusion and digital literacy in the Philippines, Cagayan de Oro City Rep. Lordan Suan has introduced House Bill No. 9749.

This groundbreaking legislation aims to waive fees for small transactions under PHP 1,000 conducted via e-wallets, a move that could significantly benefit low-income and unbanked Filipinos.

Key Takeaways

- Fee Waiver for Small Transactions: Proposed legislation to eliminate fees on e-wallet transactions below PHP 1,000.

- Promoting Digital Inclusion: Aims to encourage the use of digital banking among low-income groups.

- Enhancing Financial Literacy: The bill focuses on increasing awareness and understanding of digital financial services.

- Regulatory Oversight: The Bangko Sentral ng Pilipinas (BSP) to play a crucial role in implementing the waiver and educating the public.

Breaking Down the Bill

House Bill No. 9749, dubbed the Electronic Wallet and Electronic Fund Transfer Small Value Transaction Fee Waiver Act, proposes to make digital transactions more accessible and cost-effective for Filipinos.

This includes common activities like money transfers, cash-ins, cash-outs, and bank transfers via e-wallets.

The Objective: Financial Inclusion

The bill’s sponsor, Rep. Lordan Suan, emphasizes the significance of this move: “E-wallets offer a convenient and affordable alternative to traditional banking.

Waiving fees for small transactions will encourage wider adoption among low-income individuals, increasing financial inclusion and economic growth.”

Transparency and Competition

Suan highlights the need for transparency in fee disclosure, fostering competition among e-wallet providers, which ultimately benefits consumers.

Limitations and Exemptions

The fee waiver applies up to a daily cumulative limit of PHP 2,000.

Beyond this threshold, standard fees may apply for small-value transactions.

Role of the BSP

The Bangko Sentral ng Pilipinas will adjust the thresholds for small-value transactions and daily limits, considering factors like living costs and inflation.

Additionally, the BSP will spearhead campaigns to educate the public about e-wallets and responsible financial practices.

Impact on E-wallet Providers

Leading e-wallet providers in the Philippines, including GCash by Globe, Maya by SMART, and others, typically charge fees starting at PHP 5 per transaction.

This bill could reshape the fee structure in the digital payments landscape.

A Gateway to Financial Services

The BSP views small transactions as a gateway to broader financial inclusion, leading to access to other services like loans and insurance.

E-money accounts, currently the most widely held bank accounts in the Philippines, stand at 27.5 million users.

The proposed bill by Rep. Lordan Suan represents a significant step towards making digital financial services more inclusive and accessible in the Philippines.

By waiving fees for small e-wallet transactions, the bill seeks to encourage the adoption of digital banking among a wider range of Filipinos, promoting not only convenience but also financial literacy and economic growth.

You can read the House Bill No. 9749 here